Contemporary state and development prospects for baby food industry of Ukraine

Baby food industry of Ukraine is one of the threshold issues to be solved at the state level, as adequate and balanced nutrition is not only a required condition for healthy growth but also an important input for ensuring food security. Baby food industry development is the best investment we can make in our future.

Ukrainian baby food market is quite attractive due to the low competitive environment; its segments are represented by the following manufacturers:

– dry formulas and pablums: Khorol Infant Nutrition Factory (Nutritech, Malysh, Malutka, Malyshka TM), WAIZ Dnipropetrovsk Food Company (Nyam-Nyam TM), Southern Canning Factory (Infant Food Association, Karapuz TM);

– liquid and semi-solid milk products: Wimm-Bill-Dann Ukraine (Agusha ТМ), Yagotynske for Children (Milk Alliance, Yagotynske for Children TM), Prydniprovsky Plant (Zlagoda TM), Danone Dnipro (Tioma TM), Favor (AMA TM);

– fruit and vegetable juices and purees: Odesa Baby Food Canning Factory (Vitmark-Ukraine, Chudo-Chado TM), Southern Canning Factory (Infant Food Association, Karapuz TM);

– baby waters: Econia foreign invested enterprise (Malyatko, Akvulya TM), Hipp-Uzhhorod (Bebi Vita TM), Khorol Infant Nutrition Factory (Nutritech, Malysh TM), Myrhorod Mineral Water Factory (Aqua Nyanya TM);

– specific tea formulas: Hipp-Uzhhorod (Bebi Vita TM).

Adoption of the state special-purpose program of baby foods manufacture development for 2012–2016 was a powerful impulse resulted in dynamic growth of baby food industry and ramp-up of output.

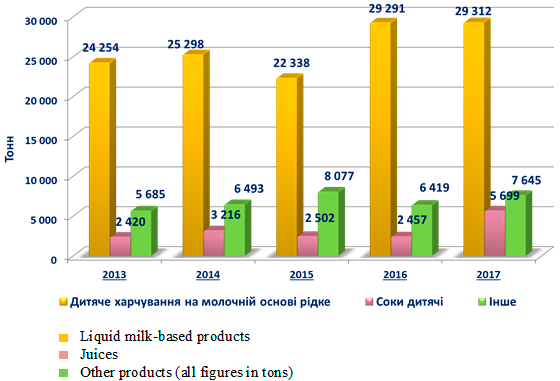

In 2013–2017, there was a steady increase in overall production of baby food products (except for 2015 when there was a slight decrease).

In 2017, according to the statistics, overall production of baby foods in Ukraine increased by 11.8 percent, i.e. up to 42.7 thousand tons (including liquid milk-based products by 0.1 percent and juices by 2.3 times).

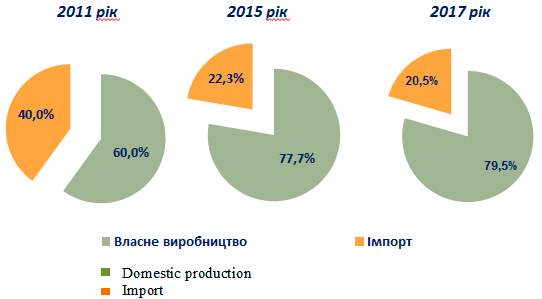

It stands to mention the brisk growth of Ukrainian baby food market in recent years. Today we meet about 80 percent of domestic demand through domestic production and the remaining 20 percent through import.

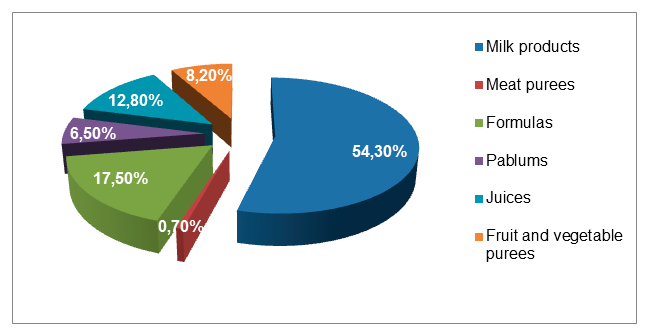

Structure of consumption of commercially manufactured baby food products in Ukraine for 2017

As for consumption structure, the share of milk and milk products significantly increased as compared to 2011, while the shares of other products slightly decreased.

Upward trends in domestic baby food industry show that saturation of the consumer market with home-grown products is a real and promising prospect.

However, some segments are still not covered by Ukrainian manufacturers, e.g. formulas for special medical purposes, canned meat and fish, cookies, macaroni and sauces. These niche segments occupied by famous foreign brands should be the next challenge for our manufacturers.

* According to the data provided by Ukrkonservmoloko, National Association of Baby Foods, Concentrated Milks and Juice Products Manufacturers.